View:

March 31, 2025

Preview: Due April 11 - U.S. March PPI - Ex food and energy to bounce from a weak February

31 March 2025 - 16:50

We expect March PPI to increase by a moderate 0.2% overall, restrained by dips in food and energy, but we expect a 0.4% bounce ex food and energy after a 0.1% dip in February. Ex food, energy and trade, we expect a rise of 0.3%.

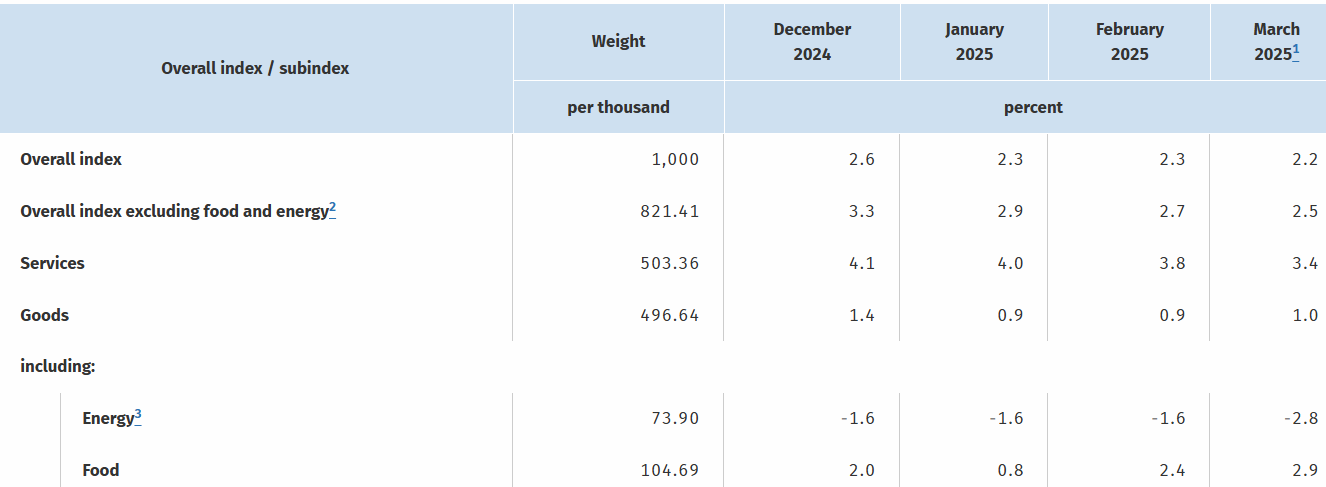

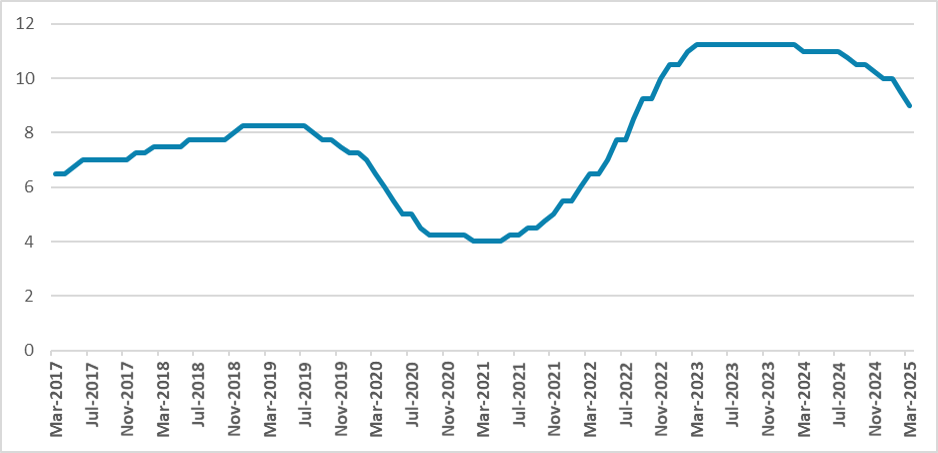

German Data Review: Lower Headline Amid Clearer Drop in Services Inflation

31 March 2025 - 12:14

Germany’s disinflation process continues, but there had been signs that the downtrend was flattening out but this changed somewhat in February and again in the March preliminary numbers. Indeed, HICP inflation fell back from January’s 2.8% to a 3-mth low of 2.6% last month and then to 2.3% in Ma

U.S. Trade Surplus Countries: No Special Treatment?

31 March 2025 - 09:04

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty

Asia Open - Overnight Highlights

31 March 2025 - 00:00

EMERGING ASIA

EM currencies perform individually against the USD despite the global market turmoil on tariff uncertainty fear. The biggest winners are INR by 0.38%, followed by PHP & TWD 0.01%; while the largest losers are KRW 0.3%, MYR 0.15%, SGD 0.13%, THB 0.11%, HKD 0.04% and CNH 0.03%.

USD/CNH is

March 30, 2025

March 29, 2025

Banxico Review: Lowering Rates Amid Tariffs

29 March 2025 - 21:29

Mexico’s Central Bank (Banxico) has cut the policy rate by 50 bps to 9%, in line with market expectations. The tone of the communiqué suggests a more dovish stance, with the board moving towards a neutral rate. Inflation has reached its lowest level since 2021, while economic growth has slowed. B

March 28, 2025

U.S. March Final Michigan CSI - Even more pessimistic

28 March 2025 - 14:16

March’s final Michigan CSI does not appear to have got any support from a slightly improved equities picture, with the overall index revised down to 57.0 from 57.9, and inflation expectations even higher, the 1-year view at 5.0% from 4.9% and the 5-10 year view at 4.1% from 3.9%.

Canada January GDP - Looking healthy ahead of the trade war

28 March 2025 - 13:19

January Canadian GDP with a 0.4% increase was even stronger than the preliminary 0.3% estimate made with December’s report. Canada’s economy was clearly gaining momentum ahead of the emerging trade war. The preliminary estimate for February is unchanged. Negatives may follow as the trade war esc

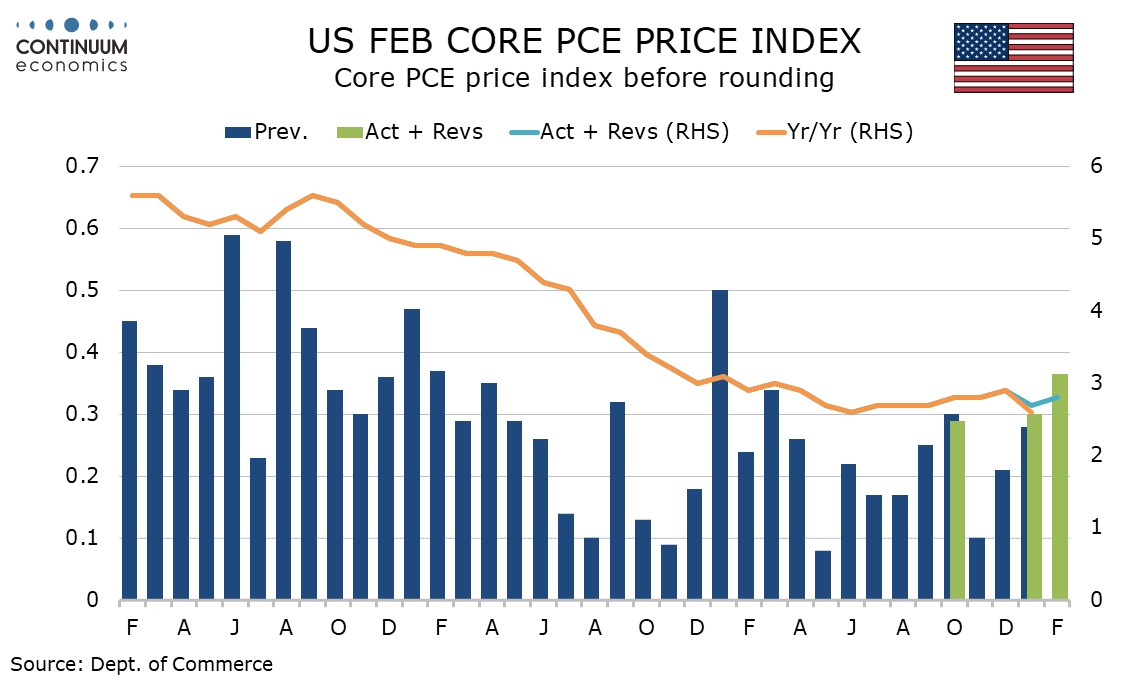

U.S. February Core PCE Prices firm, Income outpaces Spending again

28 March 2025 - 12:58

February’s core PCE price data at 0.4%, 0.365% before rounding) has come in considerably stronger than the 0.2% core CPI though the 2.8% yr/yr pace, with January revised up to 2.7% from 2.6%, is in line with a forecast from Fed’s Powell. Personal income was surprisingly strong with a 0.8% increa

Turkish Economy Remains under Pressure after Mayor of Istanbul Arrest

28 March 2025 - 11:06

Bottom Line: After mayor of Istanbul, Ekrem Imamoglu, arrested on March 23 due to fraud allegations, nationwide protests continue in Turkiye and Turkish economy remains under pressure despite a recent recovery after Treasury and Finance Minister Simsek vowed to restore stability, and Central Bank of