View:

May 17, 2024

May 16, 2024

U.S. April Industrial Production - Underlying picture looks flat

May 16, 2024 1:31 PM UTC

April industrial production was unchanged with a downward revision to March offset by an upward revision to February. Manufacturing was weak at -0.3% though outside a negative correction in autos the drop was only 0.1%, leaving a fairly flat underlying picture.

Brazil: Possible Impacts of the Floods

May 16, 2024 1:07 PM UTC

Unprecedented floods in Rio Grande do Sul, a state that contributes 6.4% to Brazil's GDP and 13.3% to its agricultural production, have submerged several cities. The immediate halt in economic activity may reduce Brazil's Q2 GDP by up to 0.4%. The federal government is increasing aid, potentially ra

U.S. Initial Claims, Housing Starts, Philly Fed - No real surprises but consistent with a modest slowing

May 16, 2024 1:00 PM UTC

The latest data is all close to consensus, initial claims partially correcting a sharp rise last week, housing starts correcting a sharp fall last month but permits seeing a second straight dip while the Philly Fed corrected from a strong preceding month but remains positive. All this is consisten

France and Japan: Debt Fuelled Growth Problem

May 16, 2024 10:30 AM UTC

Most of the surge in debt/GDP in Japan and 40% in France is due to higher government debt and this should not be a binding constraint provided that large scale QT is avoided – we see the ECB slowing QT in 2025 and are skeptical about BOJ QT in the next few years. The adverse impact of higher deb

May 15, 2024

Preview: Due May 16 - U.S. Apr Housing Starts and Permits - Housing sector losing momentum

May 15, 2024 2:02 PM UTC

We expect April housing starts to rise by 4.5% to 1380k after a 14.7% March decline while permits fall by 1.2% to 1450k after a 3.7% March decline. This would be consistent with the housing sector losing some momentum entering Q2 in response to rising mortgage rates in Q1.

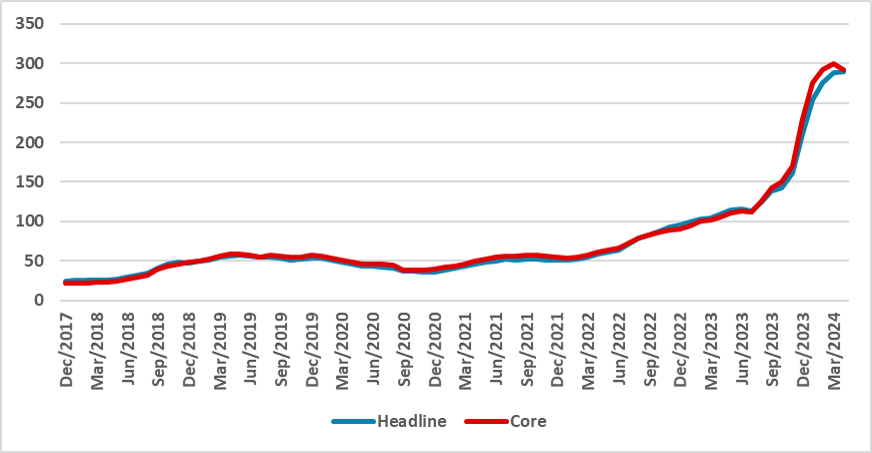

Argentina CPI Review: Monthly Inflation Drops to One Digit

May 15, 2024 12:18 PM UTC

Argentina's April CPI dropped to 8.8% after six months above 10%, with Y/Y CPI at 289%. Key rises included housing (+36%) and communication (+14.2%). Javier Milei's program and fiscal adjustments have reduced monetary emissions to zero, easing inflation. The Central Bank cut the policy rate to 40%.

Eurozone: Consumers - Still Missing?

May 15, 2024 10:34 AM UTC

Revised national account data confirmed the upside surprise in the preliminary data with EZ GDP rising 0.3% q/q. The question is whether this emergence from the modest H2 2023 recession is the start of more sustained momentum. We think not, mainly due to what are still weak consumer fundamentals